On Wednesday, May 1, Drayton Valley town council passed Mill Rate Bylaw 2024/03/F during the Regular Meeting of Council, which sets the tax rate for residential and commercial properties in Drayton Valley.

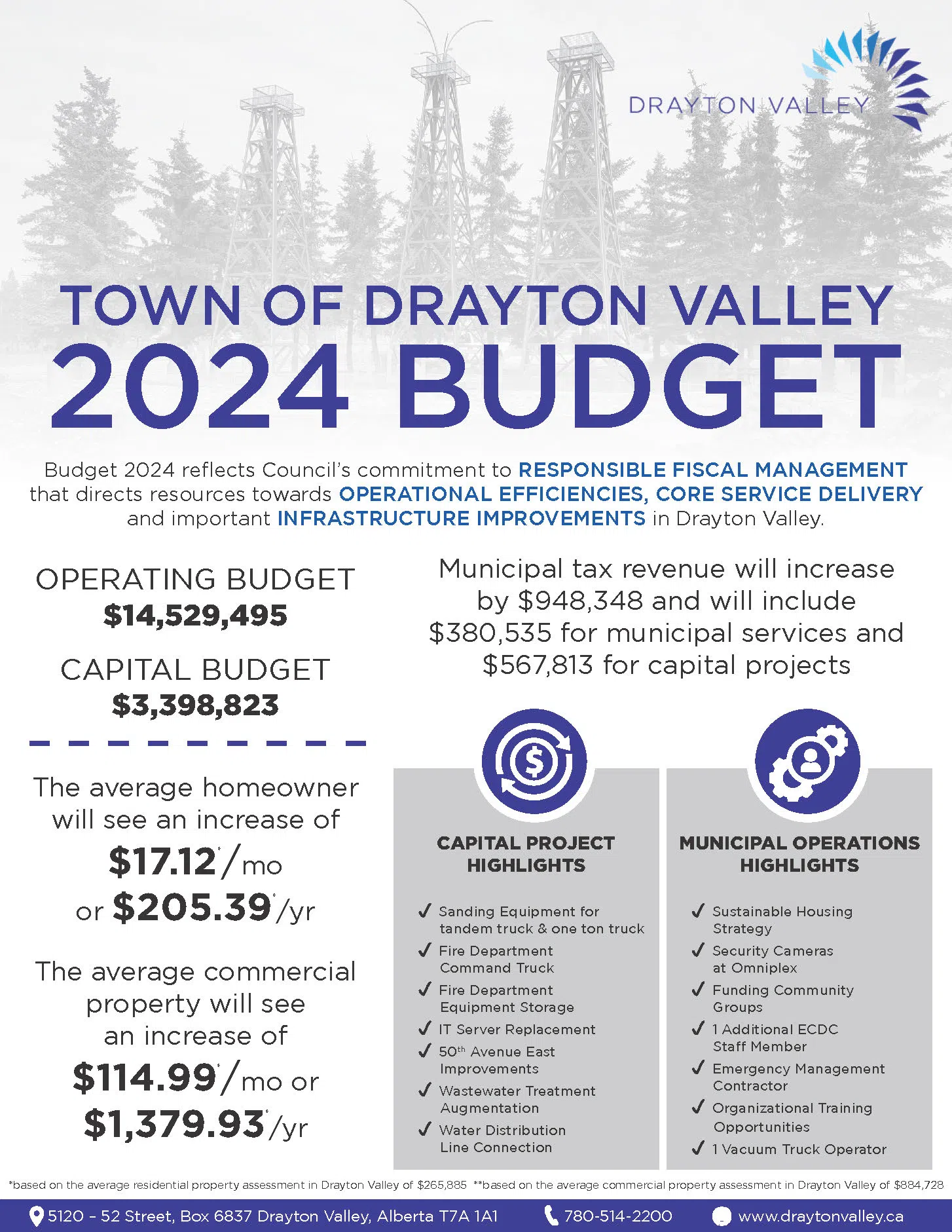

Council says the adoption of this mill rate will support the 2024 Capital and Operating Budgets that they approved in December 2023.

According to council, the 2024 Budget includes $3,398,823 in capital expenditures and $14,529,495 in operational funding.

Officials say the 2024 budget will be realized through a municipal tax revenue increase of $948,348, consisting of $380,535 for municipal services and $567,813 for capital investments.

Officials say this means the average residential property in Drayton Valley can expect to see an average increase of $17.12 per month or $205.39 per year, while the average commercial property owner can expect an average increase of $114.00 per month or $1,379.93 per year.

Comments